What to Know About Auto Theft in 2025

Learn which vehicles are stolen the most—and how to reduce your risk.

After a period of major increases, car thefts nationwide finally declined in 2024. According to data published recently by the National Insurance Crime Bureau (NICB), there were 850,708 vehicle thefts in the United States in 2024—17% fewer than there were in 2023. That’s the largest year-over-year decrease in the last 40 years, per the NICB. The number of stolen vehicles is now at pre-pandemic levels.

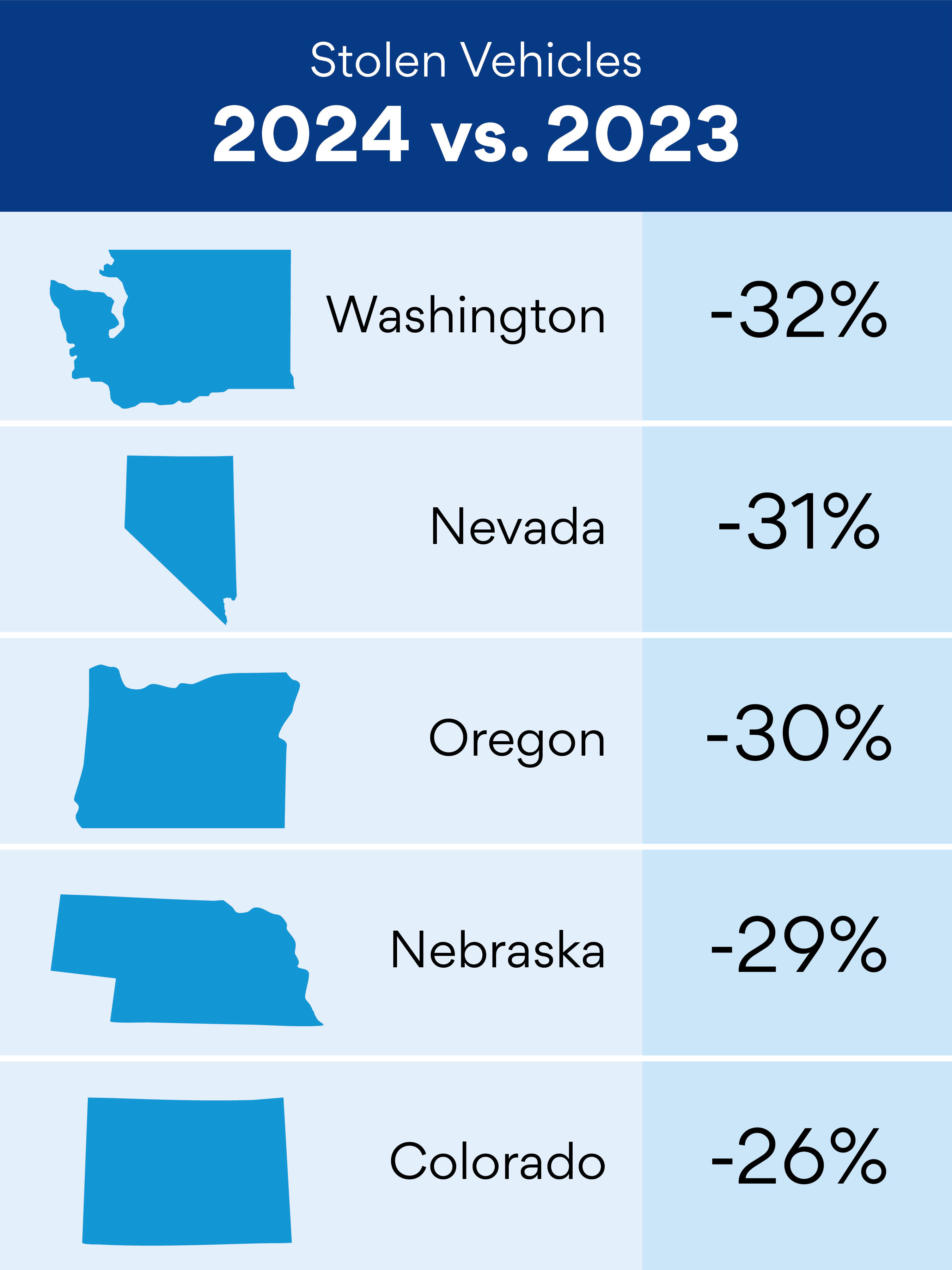

States With the Largest Decreases in Auto Theft

Some states—including several in the West—saw particularly significant decreases in vehicle thefts from 2023 to 2024. The state of Washington saw the largest decrease, dropping by 32%. Trailing not far behind, Nevada saw a 31% decrease, while auto thefts in Oregon dropped by 30%.

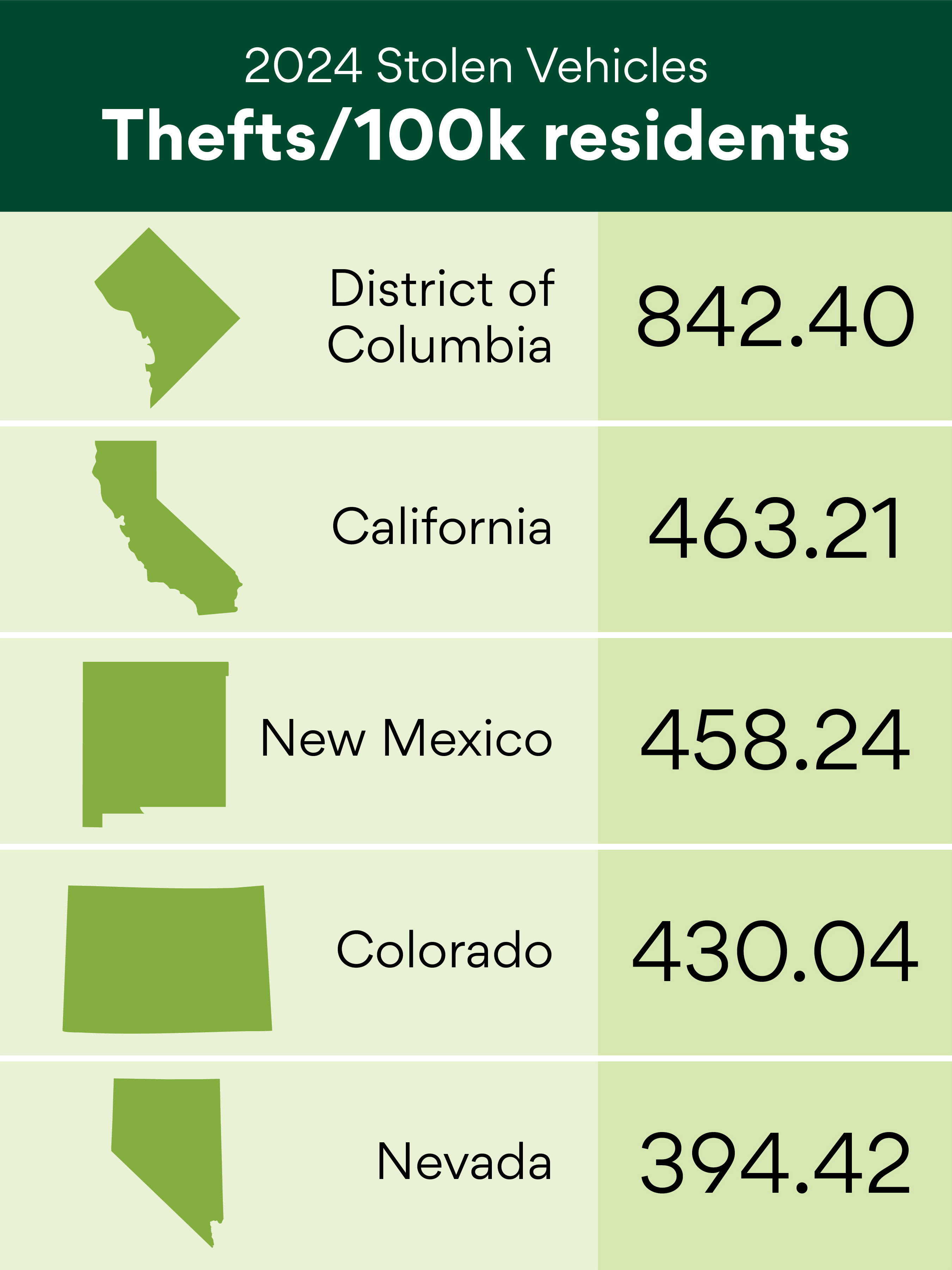

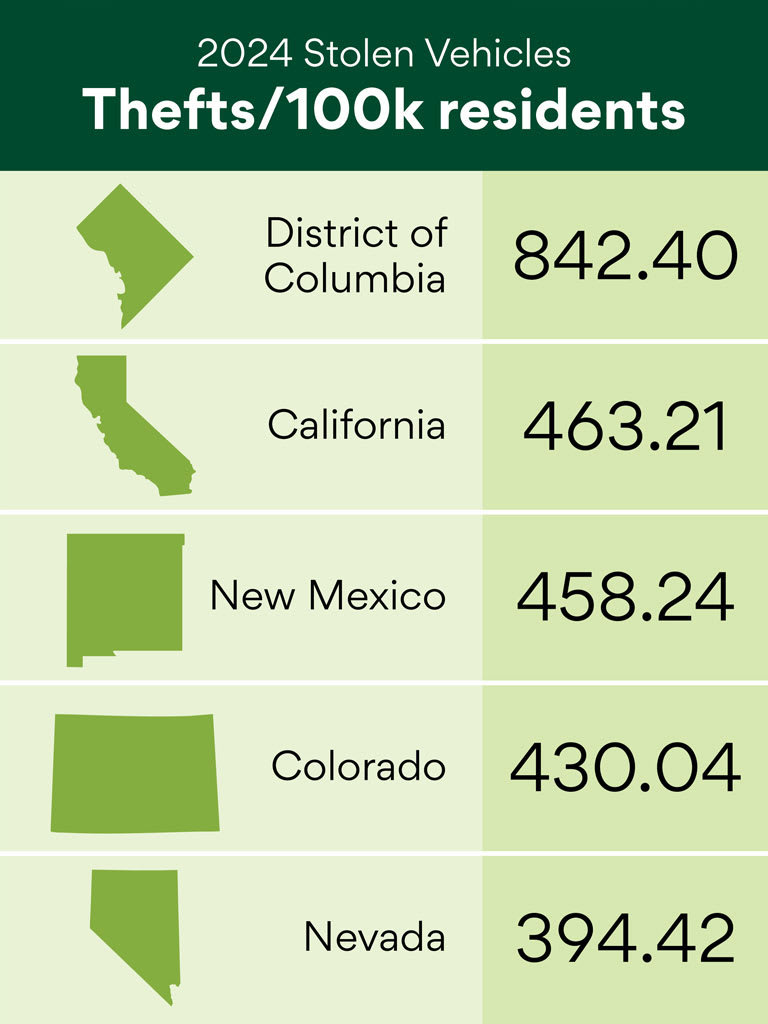

States With the Highest Rates of Auto Theft

Despite that 31% drop, Nevada still had one of the highest rates of auto theft in the country overall—about 394 thefts per 100,000 residents. But that’s nothing compared with the District of Columbia: Even after an 18% decrease in thefts from 2023 to 2024, it took the top spot in the nation, with about 842 thefts per 100,000 residents. California came in second.

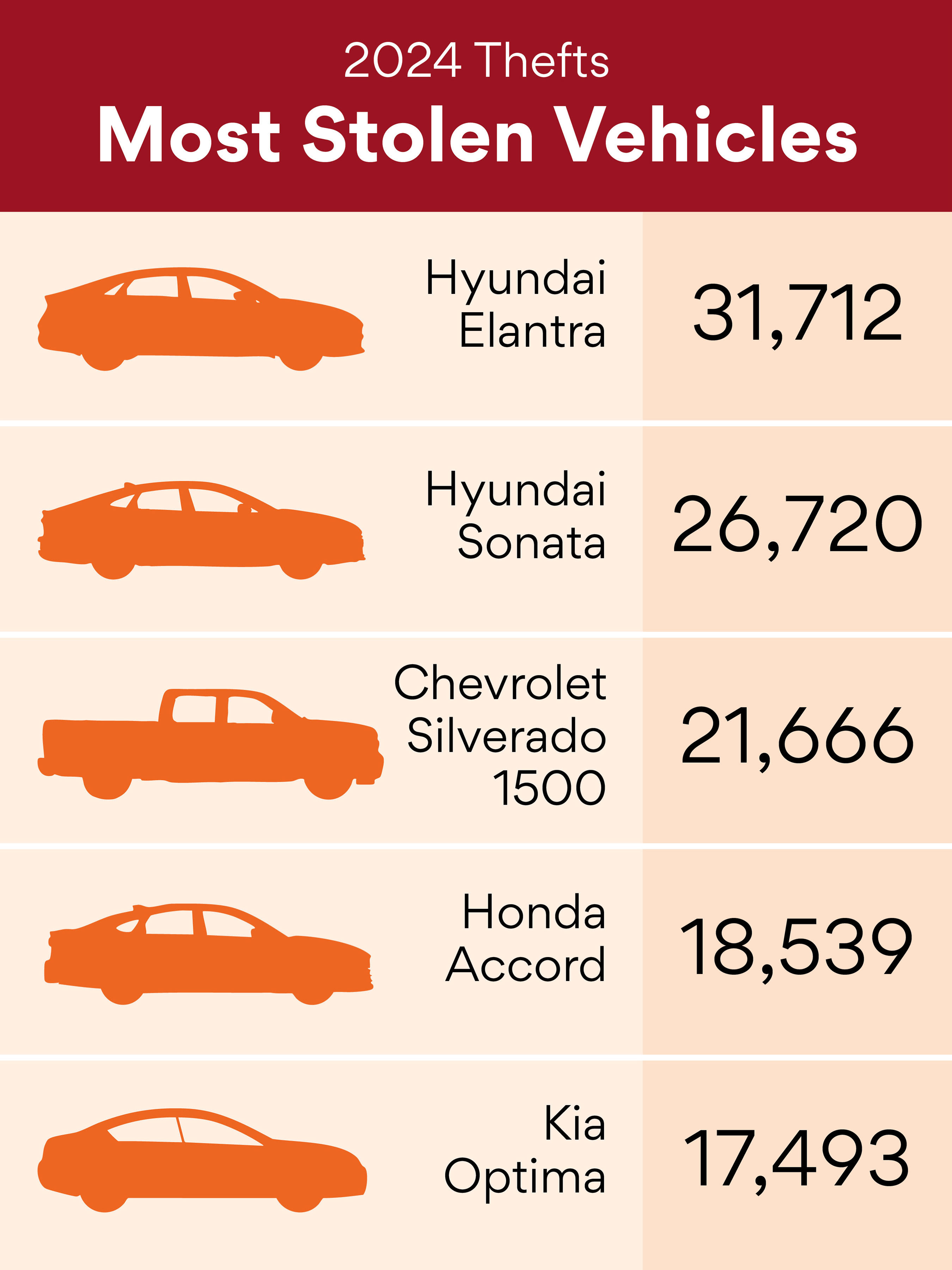

The Top 5 Most-Stolen Vehicles

Vehicle thefts also varied by make and model. The most stolen vehicles, according to NICB data, included two from Hyundai: the Elantra and the Sonata.

How to Deter Car Thieves

Having your car stolen or broken into can truly derail your life, making it harder to get to work, buy food, and see family and friends. Additionally, the logistics of reporting a theft can be incredibly time-intensive (more on that in a moment).

For those reasons, the National Highway Traffic Safety Administration suggests that you do everything you can to deter thefts, first by observing a few basics:

- Don’t ever leave your keys in your vehicle (even if you think it’ll be a quick stop).

- Make sure your car’s doors, windows, and trunk are closed and locked.

- Whenever possible, avoid parking in dark areas; find someplace that’s better lit.

- Avoid leaving valuables—or, really, anything that can be seen from the outside—in your vehicle.

There are also some less obvious tactics for preventing auto theft, including:

Turn your wheels to the right or left when parking and use your emergency brake—both make it harder for thieves to tow your car.

- Place a GPS tracker in your vehicle; if it’s stolen, you can track its whereabouts and alert the authorities. Note that Apple’s popular AirTags are not considered as effective as general-purpose GPS trackers, because of their limited range.

- Consider getting an RFID protector case for your key fob, which can help block the signal that unlocks your vehicle; modern thieves can intercept and exploit those signals to take your car.

“There is nothing that one can do to 100 percent prevent a car thief from stealing your vehicle,” explains David Bennett, senior repair manager at AAA. “If they want it badly enough, they will find a way to steal it.”

Most car thieves are looking for “quick hits,” adds Bennett. “Anything you can do to give them pause or cause extra effort, they may reconsider and move on to another vehicle.”

What to Do if Your Car Is Stolen

If you realize your car is not where you parked it and suspect it’s been stolen, the first thing to do is to file a police report. You’ll need to provide details, including:

- Vehicle details, including year, make, model, color, license plate number, vehicle identification number (VIN), and any special or unique features it might have;

- the vehicle's location before theft; and

- the last time you saw the vehicle.

The next step is to call your insurance company to let them know that your vehicle has been stolen. You’ll likely provide the same info from the police report. Getting things squared away with your car insurance company can help you file a claim if you have qualifying insurance coverage.

A standard liability or collision insurance policy won’t cover vehicle theft. Only comprehensive coverage protects you if your vehicle is stolen. If you do have comprehensive coverage, and if your car isn’t recovered, your insurance company will likely pay you the actual cash value (ACV) of your vehicle after subtracting your deductible. If you’re lucky and get your car back, your insurance company may (or may not) help you cover any damage it sustained.

If your car is stolen and you don’t have comprehensive coverage, you’ll be on the hook for any costs to replace or repair your vehicle. Finally, if you’ve taken out an auto loan or lease for your vehicle and it’s stolen, contact your lender or leasing company to let them know.

Figure out how much auto insurance you really need by speaking with an expert at AAA.